One of the scenarios considered in the Canberra-Eden Railway feasibility study was a “passengers only” option, where the railway was only completed as far as Bombala. According to the study, this scenario would have a total financial cost of $1,424 million over 50 years, returning $84.8 million of benefits over 30 years (both in net-present value terms at 7% discount rate), for a benefit-cost ratio of 0.06. Notably, this BCR is 50% higher than that of the study’s preferred scenario of a full Canberra-Eden mixed-use railway (freight and passengers); the “passengers only” option is therefore worthy of a more detailed look.

We can propose four modifications to this scenario to significantly improve its economic viability:

- Shorten the railway to Canberra-Cooma only (114km vs 214km), as the study noted that there was “little demonstrable demand beyond Cooma”

- This not only almost halves construction, operation and maintenance costs, but also halves travel time (thus halving the number of trainsets required);

- Reduce costs from 50 years to 30 years (to match the benefits);

- Correct farebox revenue to match the passenger/fare projections, and:

- Rectify the erroneous calculation of discounted present benefits,

None of these changes should be the slightest bit controversial – they are nothing more than the correct way to interpret the study’s own results – and yet the effect on project viability is utterly dramatic. Total lifetime costs drop to 30% of the original, while benefits are increased almost fivefold. The all-important benefit-cost ratio rises from a pathetically low 0.06, to 0.92, just shy of the magic number 1 at which lifetime benefits exceed lifetime costs. This should already place the Canberra-Cooma railway firmly on the “worth a closer look” list.

| Lifetime costs and benefits, $million | Original | Corrected | |||

|---|---|---|---|---|---|

| Real | NPV 7% | Real | NPV 7% | ||

| Capital cost | (1336.5) | (1069.2) | (712.0) | (569.6) | |

| Rollingstock capex | (156.0) | (112.6) | (78.00) | (56.3) | |

| O&M | (1000.3) | (326.4) | (319.8) | (156.5) | |

| Residential offset | 100.0 | 80.0 | 100.0 | 80.0 | |

| Ticket sales | 68.3 | 16.4 | 759.3 | 281.8 | |

| TOTAL FINANCIAL COST | (2324.5) | (1424.0) | (250.4) | (420.6) | |

| ECONOMIC BENEFITS | 660.7 | 84.8 | 1168.2 | 385.1 | |

| BENEFIT / COST RATIO | 0.06 | 0.92 |

Additional corrections

But that’s not the end of the story. The above calculation is the result of fixing basic arithmetic errors and reducing the railway length, but still retaining all the cost and benefit assumptions of the study. Many of these assumptions are highly suspect, and if corrected, push the Monaro Railway firmly into viability.

Capital Costs

The capital cost of the railway from Canberra to Bombala is $1,336.5 million (undiscounted), however this amount includes several questionable cost items, as detailed in a previous post. The following savings are applicable to the Canberra-Bombala section:

- Trackwork $142.3m

- Passive Level Crossings $10.5m

- Concrete Culverts $28.5m

- Colinton Tunnel $7.7m

- Earthworks $32.7m

- Soft costs $133.0m (60% of subtotal)

- TOTAL SAVING $354.7m

This reduces the CBR-BOM section’s undiscounted capital cost to $981.9m. Canberra-Cooma is only 53% of the rail distance to Bombala; proportionally reduced for the shorter length, it comes to $523.1 million (or $418.5 million NPV @7%).

Operation and Maintenance Costs

The study’s original costs for operation and maintenance in the “passengers only” scenario are very slightly higher than the “central scenario” from Canberra Airport to Port Eden, which included both freight and passengers over a longer railway ($326m vs $324m in NPV terms). This is highly implausible; we will obtain an alternate estimate by calculating the operating costs directly.

The Inland Rail Alignment Study estimated “below rail” O&M to come to $25,540 per track-kilometre, annually. This comes to $2.9m/annum for Canberra-Cooma, or $87.3 million over 30 years ($36.1m NPV@7%).

European benchmarks suggest that above-rail operating costs for modern DMU passenger trains should be around $2.75 per car-km, or $11/train-km for the four-car sets proposed here. Taking the study’s demand estimate of 12 trains per day over a 114km route, that makes about 498,000 train-km per annum (doubling to 996,000 by 2036); O&M would therefore come to a total of $279.4 million over 30 years ($100.3 million NPV@7%).

Total O&M over 30 years (above and below rail) should therefore total $366.7m ($136.4m NPV@7%). This is actually fairly close to the figure we obtained by scaling the original O&M cost down for the shorter railway length.

Land Sales

Release of railway land for residential development was a major source of income for both the Transport for New South Wales study, and the original concept plan by the Cooma Monaro Progress Association. However, the amount of land offered by the former is around a tenth of that proposed by the CMPA study (1000 dwellings over 4 years, compared to 10,000 dwellings over 10 years). This is due to the TfNSW study’s decision to only offer detached housing, at a far lower density than achievable with medium-density mixed-use precincts.

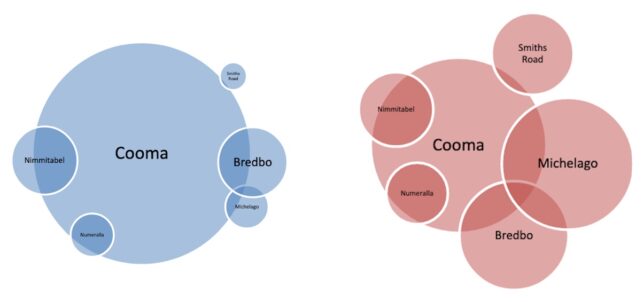

There is no shortage of undeveloped land; whatever required area could be appropriately re-zoned within the existing town limits. Alternatively, there is sufficient land within the actual railway’s boundaries to pursue a development strategy of co-located station and residential precincts without requiring any private land acquisition at all. Either way, it is entirely plausible that a land sale program totalling 1,000 dwellings per year could be maintained for a decade. If spread out over five station precincts (Cooma, Bredbo, Colinton, Michelago and Royalla), such a rate of growth could easily be accommodated by the Snowy Monaro Regional Council’s long-term growth plan for the Monaro region.

If we assume land sales of 10,000 dwellings per year, at a developer margin of $75,000 per dwelling, this would total $750 million over 10 years ($526.8 million NPV@7%).

Source: Cooma-Monaro Settlements Strategy 2016-2036.

Avoided Passenger Vehicle Operating Costs

The study’s economic benefit due to avoided passenger vehicle operating costs appears to have been severely undercounted. It lists the undiscounted real benefit over 30 years as $109.2 million. However, according to the study’s own passenger estimates, we would expect over 43 million passenger-trips in this period. This implies an avoided cost of just $2.53 associated with each rail trip, which is an implausibly low figure.

The average Canberra commute is about 12km long; assuming a typical car occupancy of 1.6, we can conservatively assume that each train journey avoids 0.625 car journeys of 12km length; the ATO’s “cents per kilometre method” (a very conservative measure) would result in avoided passenger vehicle operating costs of $233.7 million ($86.7 million NPV@7%).

Avoided parking fees should also be considered; such fees are generally $15 per day and up. The avoidance of parking would be somewhat offset by a rail commuter likely needing a connecting tram or bus from the Canberra terminus (currently $3.22 for an adult peak fare), but on these numbers we can still account for a saving of $4.28 per one-way rail trip. This is a substantial amount, coming to $115.8 million over 30 years ($43.0 million NPV)

Therefore, avoided vehicle operating costs should total $349.5 million ($129.7 million NPV@7%). This brings the total passenger benefits to $164.1 million (NPV@7%).

Additional error summary

In total, these additional errors combine to reduce total financial cost to $611.1 million over 30 years (NPV), while increasing total benefits to $1274.6 million (note that land and ticket sales have been added to the “benefits” total, as otherwise they would reduce Total Financial Cost to less than zero, thus rendering the Benefit-Cost ratio meaningless). Benefit-cost ratio increases to almost 2.1, indicating a strongly viable project, with good potential to attract private-sector interest for a public-private partnership.

| Real | NPV@7% | |

|---|---|---|

| Capital cost | (523.1) | (418.5) |

| Rollingstock capex | (78.0) | (56.3) |

| O&M | (366.7) | (136.4) |

| TOTAL COSTS | (967.8) | (611.1) |

| Land Sales | 750.0 | 526.8 |

| Ticket sales | 759.3 | 281.8 |

| Passenger benefits | 440.0 | 164.1 |

| Consumer surplus | 759.3 | 281.8 |

| Residual value | 153.7 | 20.2 |

| TOTAL BENEFITS | 2862.4 | 1274.6 |

| BENEFIT-COST RATIO | 2.09 |

Further external benefits could also be considered (as detailed in a previous post), notably provision of affordable housing (NPV of $499.5m), congestion reduction ($15.5m), and decentralization ($66.6m). If these additional benefits were included, the BCR would exceed 3. However as these are not “errors” per se, but rather arguable additional benefits, we will not include them in the formal analysis.

Tuggeranong Bypass

The original study rejected the proposed deviation at Tuggeranong, which would bypass a long section of slow, tight curvature with a relatively large viaduct. The TfNSW study suggested this would cost an extra $160m, the vast majority of this cost (90%) comprising a single, 1.8km long viaduct. The remaining $16m was for 1.2km of approach works, plus the track itself. The time saving would be 3:15 minutes, which was not considered worth the expense.

By my analysis, the Tuggeranong Deviation would give a far greater time saving than this. The study appears to have considered only the length of the actual deviation itself (a 3km deviation, replacing a 4.7km section of original track), and not the approaches at either end, which would under any reasonable scenario also be upgraded to 160km/h. Taking this extra length into account increases the time saving to 5:55 minutes. Over the 30 year study period, assuming a time-value of $20/hr, this would value the direct travel time savings of the deviation at $85 million ($32 million NPV).

| Original alignment | New deviation | |

|---|---|---|

| Length | 8.1km | 5.8km |

| Speed | 60km/h | 160kmh |

| Travel time | 8:06 | 2:11 |

Furthermore, the $80m/km cost of the viaduct itself is implausibly high. This cost would be appropriate for a concrete beam bridge with a long span, perhaps 200m+. The proposed viaduct would never be more than about 50m high at its highest point, suggesting that a mainspan of 50-100m would be appropriate. Such a viaduct should cost around $40m/km (see e.g. Inland Rail Alignment Study 2010). Also, the plan above shows that a viaduct as short as 1.4km is possible without excessive approach earthworks. This would reduce the deviation cost to perhaps $80 million. While this is still well in excess of the direct travel time benefits, it is highly likely that additional benefits would be of sufficient magnitude to justify the expenditure (for example, a greater level of induced demand, the ability to be co-utilised for a future high-speed rail corridor, etc). In any case, with the corrected financial projections, the bypass will be easily affordable, delivering an unrestricted 160km/h alignment between Canberra and Cooma.

Header image: Chakola, New South Wales by Grahamec at Wikipedia

Good work Edwin. Hopefully future studies can utilise local talent rather than running back to Sydney all the time.

Love your work.