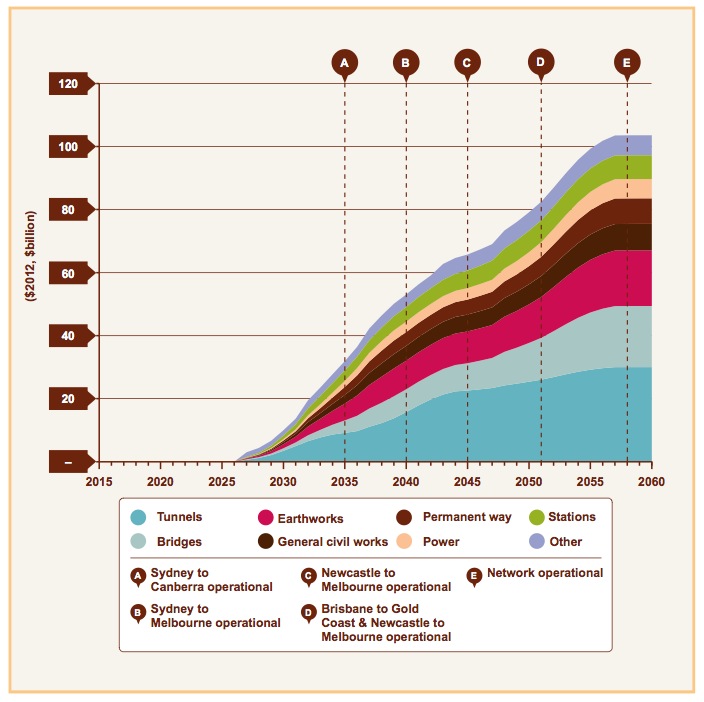

The 2013 Phase 2 report into high-speed rail by AECOM took two years and 20 million dollars to complete, and it is a remarkable piece of work, comprising detailed alignment routes, costings, economic analysis and much more. It is easily the most comprehensive HSR study undertaken in this country to date. It’s a shame the $114 billion price tag ensures that high speed rail will remain forever a pipe dream. Railways are just too damn expensive to work in Australia, huh?

But is this really the case? It was only in 2001 that a previous HSR study by Arup predicted the total cost of a Melbourne-Canberra-Sydney-Brisbane line would be between $33 and $59 billion. Before that, in 1990 the Very Fast Train joint venture estimated the cost at $16 billion. And before that, in 1984 the CSIRO estimated just $2.5 billion (between Sydney, Canberra and Melbourne only). What gives? Inflation hasn’t been that bad over the last few decades. What exactly makes up AECOM13’s expenditure projection, and why is it so much higher than past estimates?

According to AECOM13, a “typical” kilometre of HSR railway costs about $65.2 million ($114 billion ÷ 1748km). Adapting the data on page 319, this comprises:

- Tunnels $17.2m (26.3%)

- Bridges $11.9m (17.0%)

- Earthworks $10.1m (15.5%)

- Civil works $4.8m (7.4%)

- Permanent way $4.6m (7.1%)

- Stations $4.5m (6.6%)

- Power $3.5m (5.4%)

- Land $2.2m (3.4%)

- Signal/Comms $1.0m (1.6%)

- Depots/facilities $0.4m (0.6%)

This only adds up to $59.3m/km; the remaining $5.9m/km (9.1%) is a vaguely defined “project development cost” – over the whole project, that’s $10.4 billion dollars before a single rail is laid. This should outrage anyone concerned about good governance.

The actual rails, sleepers and ballast (referred to as “permanent way”) make up only 7.1% of the total cost. There is undoubtedly some room for cost saving measures in AECOM13’s estimate. Almost two thirds of the total cost is in tunnels, bridges and earthworks, so in the quest to build a cheaper high-speed railway, the place to start looking is with those elements. Let’s look at what the study has to say about that in greater detail, and see if there is any fat to trim. The cost estimates are found in Chapter 7 and Appendix 4B.

Tunnels

The study bases its tunnel cost assumptions on a detailed analysis of a hypothetical 5km, twin-bore HSR tunnel constructed by tunnel boring machine (TBM). The total cost comes to $738.4 million, or $73,843 per bore-metre. According to this study by the Worcester Polytechnic Institute, that’s towards the high end of worldwide experience (data on page 41), but nevertheless, just to be on the safe side AECOM13 rounds it up to $75,000. What’s in this cost estimate?

The cost of tunnel works alone (digging the bore, lining it with concrete panels, waterproofing, cross-passages, pavement, drainage, and service ducts) was estimated to be $257.3 million, which is $25,729 per bore-metre. Setup costs were estimated at $123.3 million ($12,325 per bore-metre) – this included $86 million for the tunnel boring machine alone. Temporary services came to $9.8 million ($981/m), while “tunnel fit-out and other” came to a staggering $348.1 million ($34,807/m). As the single largest item on the list, this warrants some detailed investigation. “Fit-out and other” includes:

- Ventilation: $6m ($600/m)

- Fire: $9m ($900/m)

- Electrical: $3.75m ($375/m)

- Lighting: $11.25m ($1,125/m)

- Track: $15m ($1500/m)

- Slab track base: $7.5m ($750/m)

- Overhead line: $9.06m ($906/m)

- Comm. & Signals: $9.08m ($908/m)

- Mark-up: $277.4m ($27,744/m) ←WTF!!

“Fit out” costs seem reasonable enough, but “Other” ends being the single biggest cost in the entire project – 37.5% of the total cost, more than actually building the tunnel!! How in the world can this be justified? The only item in “other” is “mark-up”, which is defined to include “contractor overheads, supervision and site establishment.” Didn’t we already cost in site establishment back in the $123m “setup costs” line-item?

The study goes on to describe the required works in some detail in an appendix. Some useful points are made, for example, tunnels shorter than 500m have lower requirements – they are not legally required to have fire protection, sophisticated ventilation, or dedicated emergency exits, which greatly reduces the cost. However there is no attempt to justify the enormous “mark-up” cost. It’s not even addressed. In fact, the appendix does not quantitatively describe the costs at all.

Fortunately, the WPI study cited above also includes typical compositions of tunnelling costs, which includes contractor’s fees. The results indicate that the cost of rail tunnels was generally comprised of 54% excavation and lining, 10% rails, 8% other fit-out (referred to as Electrical and Mechanical), and 28% “Preliminaries and General” (a loosely-defined term relating to contractor overheads and site costs). For road tunnels the numbers were 76% excavation and lining, 7% fit-out, 1% roadway, and 16% P&G. The AECOM13 prototype tunnel was 35% excavation and lining, 3% rails, 7% fit-out, and an enormous 56% P&G (including site establishment, temporary works and mark-up). If we move “site establishment” to “excavation”, it increases excavation to 51% and decreases P&G to 40%, but in either case, it is clear that AECOM13’s mark-up cost is excessive by world standards.

It is difficult to imagine a justification for including a contractor mark-up that substantially exceeds the cost of actually building the tunnel, and most of the remaining fit-out costs (track, overhead lines, etc) should be calculated independently anyway. Reducing “mark-up” by approximately half would more closely match the WPI study’s findings. The true cost of tunnels is probably something in the realm of $25,000 to $55,000 per bore-metre, which would be more in line with international experience (UPDATE: See Tunnels).

Bridges

Likewise, the report’s assumed cost of bridges seems very high, at $110 million per route km (or $55,000 per track-metre). This cost refers to a generic segmental-concrete bridge type, and is used throughout the report in order to reduce difficulty of calculation. However, a breakdown of different types of bridges is given in Appendix 4B, converted here to dollars per track-metre:

- Box-culvert (for floodplains) $15,000 – $35,500

- “T” beam (up to 10m high), span <20m $35,000

- “T” beam (up to 30m high), span <20m $45,000

- “Box ” beam, span 20-50m $52,500

- Cantilever beam, span 50-120m $70,000

- Cable-stayed, span 120-200m $87,500

- Concrete Arch, span >200m $107,500

These cost assumptions are very high, even considering the fact that rail bridges must be designed for somewhat higher loads than road bridges. At these prices, the cable-stayed Anzac Bridge in Sydney would have cost 87,500 dollars * 8 lanes * 805 metres = over $560 million (it actually cost $170 million in 1995, and that included significant extra works such as on-ramps, approach spans, pedestrian lanes, and it additionally was built very high to allow ships to pass beneath, and is of a far longer span). How can box culverts for crossing shallow floodplains be costed at $30 to $70 million per kilometre? Culverts are just cheap, mass produced concrete segments, yet AECOM13 assumes they cost almost half as much, per lane-metre, as a cable-stayed bridge (and far more than the actual cost of the Anzac bridge). It’s not at all clear how so high an estimate was calculated, and thus it does not seem credible. Hot Rails will use a different source for the cost of bridges (UPDATE: See Bridges and Viaducts).

Earthworks

AECOM13’s cost assumptions for earthworks (appendix 4B, pp 9) seem pretty reasonable:

- Mass-haul $2 per m3, per km

- Cut (rock) $26 per m3

- Cut (non-rock) $9 per m3

- Fill $11 per m3

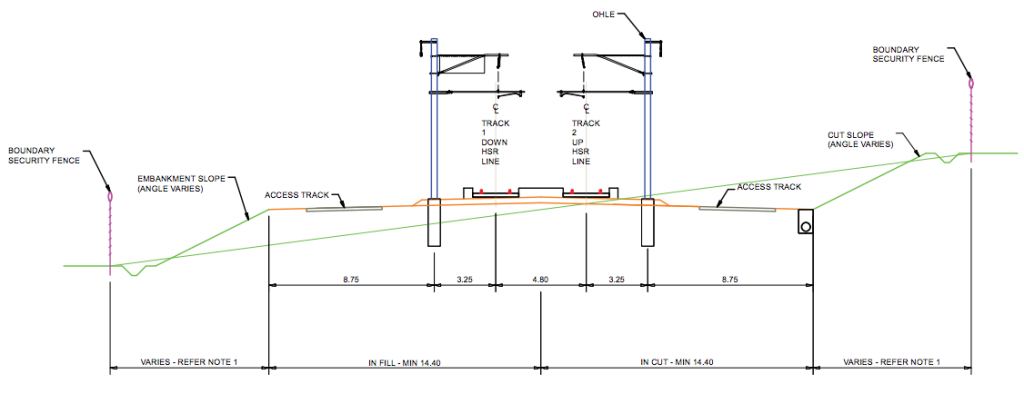

However, the indicative track profile shows an unnecessarily wide alignment, which will result in a far greater calculated volume of earthworks than needed:

Note that the track itself (including the overhead wire poles) is only 11.3m wide, yet the inclusion of twin access tracks almost triples this to 28.8m. It is not explained why access tracks are needed at all (let alone twin tracks), nor why they need to be at the same level as the rail line, nor why each access track needs to be over twice as wide as a standard road lane (which is 3.6 to 4 metres rather than 8.75), nor why they need to be bituminised. Dedicated access tracks are rare on international examples of high-speed lines (see satellite imagery of the French LGV Sud-Est, the British approach to the Channel Tunnel, or Japan’s Shinkansen). All this serves to greatly inflate the required volume of earthworks, so while the volumetric cost is indeed plausible, the amount will have been substantially overestimated if the “typical section” is indeed the assumption used throughout the report (though this is far from clear).

Curiously, in Appendix 2B (pp 13, section 3.2.1) it is claimed that deep cuttings can be economically competitive with tunnels to depths of up to 50 metres. This seems rather extreme; 50 metres is an enormously deep cutting (for perspective, there is 49 metres of clearance below the Sydney Harbour Bridge) and a quick Google search yields only a few results for cuttings deeper than this – all multilane roadways where the large width makes a tunnel impractical.

Additionally, an aerial view of the Skinkansen railway (same link above) which traverses quite hilly country shows numerous short tunnels of less than 50 metres in depth (estimated using Google Earth’s elevation profile tool). 50 metres of cut also needs to go somewhere, necessitating a very substantial volume of fill within a reasonable distance (say, under 10 kilometres). It will be interesting to attempt to recreate this cost comparison, using both the AECOM13 assumptions and the Hot Rails assumptions. (UPDATE: See Earthworks)

Civil works

This refers to all ancillary works required to make the rail track safe and minimally obtrusive to existing environments. These include human and fauna proof fencing, retaining walls, slope stabilisation measures, noise attenuation walls, site clearance and demolition, relocation of existing utilities, access tracks, and revegetation (among others). Some of the items (such as security fencing) are located along the entire length, while other items (say, noise attenuation walls) are only used occasionally. There are a large number of individual items listed in Appendix 4B, page 10; some of the major ones are:

- Security fencing (rural) $90,000/km

- Security fencing (urban) $200,000/km

- Slope stabilisation (10-30°) $2,160,000/km

- Slope stabilisation (>30°) $5,780,000/km

- Noise attenuation (rural) $4,800,000/km

- Noise attenuation (urban) $9,500,000/km

- Site clearance/demolition $135,000/km

- Longitudinal drainage $475,000/km

- Cross drainage $390,000/km

- Minor access roads $1,500,000/km

- Revegetation/landscaping $290,000/km

- Utilities relocation (rural) $125,000/km

- Utilities relocation (urban) $575,000/km

The exact proportion of each item used is not noted in the study, but whatever it is, it comes to an average of $5.3m/km. Once again, it is hard to see where this enormous number comes from. Let’s say fencing, site clearance, drainage and utilities relocation are non-negotiable, and occur along the entire length of the track. That adds up to $1.08 million per kilometre in rural areas (ie, most of the length), or $1.64 million in urban areas. That means there is a hell of a lot of very expensive infrastructure being built, for which the justification is not clearly apparent in the report. Access roads are not used in the majority of HSR lines worldwide, the cuttings on the Hume Highway and every other freeway in Australia seem to get by just fine without millions of dollars worth of unspecified “slope stabilization,” and noise attenuation walls shouldn’t be necessary except in very rare circumstances – AECOM13 assumes the capitals are mainly accessed by tunnel, and the regional towns are bypassed.

The costs do appear to be reasonable for the most part, what isn’t clear is why so much civil infrastructure is being built that we end up with over $5 million per kilometre. In the Hot Rails strategy, a large proportion of the general civil works will be un-necessary due to reusing the existing alignment. (UPDATE: See General Civil Works)

Permanent way (track)

The cost data for the construction of capping (the top layer of earthworks, on which ballast is laid), ballasted track, concrete slab track, and turnouts and crossings were developed from first principles using track specifications taken from the Nuremburg-Ingolstadt line in Germany. It is in line with recent worldwide experience for high-speed railway construction, which is substantially more expensive than for tracks with lower speeds (for which tolerances are not as fine).

- Capping $410,000/km

- Turnouts/crossings $200,000/km (average)

- Ballasted track (dual) $2,500,000/km

- Slab track (dual) $3,550,000/km

It should be noted that this is substantially more expensive than the cost for medium-speed rail (150-200km/h), and much more expensive than low-speed and freight railways. The cost of railway construction is strongly correlated with the design speed. AECOM13 is designing the track for 400km/h, faster than its proposed maximum speed and faster than any existing railway in the world. Overspecification has consequences – and this report appears rife with it. (UPDATE: See Track costs)

Signalling and Communications

Signalling and communication infrastructure are costed individually, including track signalling, transponders, control centres, communication cabling, and even trainboard Wi-Fi hotspots and repeaters. In total it comes to $1.1m/km, which is reasonable when compared to international sources. Unusually for AECOM13, if anything it is a little optimistic. A masters thesis submitted to the University of Iowa in 2011 entitled A planning methodology for railway construction cost estimation in North America suggested that “control and signalling” costs for a 220mph (354km/h) dual-track railway would be $2.298 million USD per mile (about $1.43 million USD per kilometre, and the AUD was roughly at parity with the USD at the time).

Nevertheless, AECOM13’s numbers for S&C are specifically for Australian conditions, which it assumes will involve long distances between stations. It is close enough to agreement to be treated as credible. (UPDATE: See Signalling and Control)

Power

Power infrastructure consists of two major components: transmission, which involves power lines from the National Electricity Market (“the grid”) plus substation construction or upgrade, and distribution, which consists of overhead line, traction power substations, and autotransformers. It adds up to $3.8m/km. The University of Iowa thesis cited above suggests a cost of $2.12m/km, but included only distribution infrastructure, not transmission. The studies are therefore largely in agreement.

- Substation (new) $50m

- Substation (upgrade) $5m

- Transmission cable $0.5m/km

- Overhead line $1.5m/km

- Traction substation $36.1m each (every 60km)

- Autotransformer $5m each (every 10km)

The Hot Rails strategy is of course to use diesel engines, and so the cost of power infrastructure will be zero. (Update: see Power)

Stations and Facilities

The strategy of station construction in AECOM13 (Appendix 4B, from page 13) leaves much to be desired. Regional stations are few in number, very far from the town centre (which eliminates all possibility of any use mode other than park-and-ride or set-down/pick-up) and extremely elaborate (they are assumed to cost $70 million each, excluding land or parking facilities). Existing city stations have been assigned enormous redevelopment costs – Sydney $1.15 billion, Brisbane $638 million, and even the almost brand-new Southern Cross in Melbourne $465 million. It is unclear why the existing platforms (or at least a less expensive redevelopment thereof) would be insufficient.

The strategy of avoiding the town centres of regional areas severely curtails the regional development potential of High Speed Rail, and indeed, Chapter 9 of AECOM13 duly finds that the regional development effect of HSR will be modest. This is not the case in most European networks, where HSR access to town centres has been prioritised. Adopting a similar approach in the Australian experience will both increase regional development benefits, and save greatly on station costs.

AECOM13 assumes several dedicated stabling and maintenance depots will be required, at a cost of up to $170m each. This will likely not be required under the Hot Rails plan, in which the alignment will have access to existing depots, and the rollingstock is substantially similar to that already in use. (UPDATE: See Stations)

Land Acquisition

The final class of cost addressed directly in AECOM13 is the compulsory acquisition of land for the corridor, stations and other facilities. The total area of land to be acquired is 13,100ha at a cost of $3.5 billion, meaning the average cost of acquisition is $267,000/ha. While this would be a fairly good deal in an urban area, most of the land is in rural areas, where the average cost is more like $2000/ha, or perhaps up to $20,000/ha for small “hobby farm” blocks close to major regional centres. Either way, with the vast majority of the 13,100ha being acquired in rural areas, the land cost seems very high.

This may be due to a so-called “compensatory uplift” applied to land acquisitions, supposedly to compensate for the fact that acquired land normally accounts for only a small portion of the owner’s total block size. Why it follows that the government must therefore pay owners between 2 and 10 times market value for their acquired land is not clearly explained.

The strategy of reusing existing corridors will largely eliminate the expense of land acquisitions. The few areas of new alignment will be able to be accurately costed by comparative valuation with neighbouring properties. (UPDATE: See Land acquisition )

Project Development Costs

Supposedly based on international experience, AECOM13 adds an essentially arbitrary cost called “project development”, consisting of:

- Pre-phase and preliminaries: $1.5b (15%)

- Planning, design and procurement: $2.7b (26%)

- Construction oversight: $5.6b (54%)

- Commissioning: $0.5b (5.2%)

- Total: $10.4 billion (!)

How this can be justified is not remotely addressed. The “definition” of each cost class is just a simple rephrasing, eg “Pre-phase and preliminaries costs would be incurred at the commencement of the future HSR program”. The “international benchmarks” supposedly had development costs of 7.5% to 16.5% of aggregate capital costs, but the study then states that these numbers included land acquisitions! Additionally, many of the actual construction costs already take into account construction oversight (eg, the estimate for tunnels). The study claims to have adjusted the “development cost” percentage to take account of land acquisition, and the fact that the Australian system is far longer than the benchmarks considered, but exactly what effect this was assumed to have is not stated.

If we assume that project development costs are evenly distributed over 40 years, and each person so-employed has an executive-level salary of $250,000 per year, it would require a workforce of 1040 bureaucrats to rack up a bill of $10.4 billion. As at April 2013, that’s the entire workforce of the Department of Infrastructure and Regional Development. The project development costs are excessive by any reasonable measure, and should probably fall within the normal operations of the Department of Infrastructure anyway. The Hot Rails strategy shall not consider development costs.

Track Geometry

AECOM13 has adopted a very large minimum curve radius of 7285m (with 7900m desirable), to allow for future speed upgrade to 500km/h. Although this speed has been exceeded by TGV trains under test conditions, there are presently no commercial SWSR systems that come close to this speed. While future-proofing is a laudable goal, it is better in my opinion to devise a financially viable proposal. To do this requires an aggressive minimisation of capital cost, for which reduction of curve radius is paramount. The track radius should be specified to the proposed rollingstock, not some arbitrarily high forecast of what might be needed in the future. (UPDATE: See Track Geometry)

Conclusion

The AECOM13 study is a valuable resource for anyone seeking to design a high speed railway in Australia, and is the closest thing to an actionable plan since the VFT joint venture a quarter-century ago. But unfortunately, the data for the two most important components is fatally flawed. While many of the cost estimates are easily verifiable against international experience, tunnels and bridges are very expensive in comparison to past infrastructure projects. In the absence of any compelling explanation for this discrepancy, it is difficult to take the estimates at face value. By far the largest component of the high speed railway’s cost is in tunnels and bridges, so it is essential to ensure those elements are accurately estimated. Additionally, although other cost estimates in the report appear reasonable, the total cost of each indicates that an excessive amount has been specified for no clear reason. It is tempting to conclude that the purpose of the report was to predict a cost so astronomical that public outrage over government spending would kill the project. It seems for the moment that it has succeeded.

Hot Rails will use the AECOM13 study extensively, but the data for tunnels and bridges will have to be augmented by additional studies from around the globe, at the estimates do not stand up to scrutiny.

Edwin, a cracking piece of work, well done. So many flaws in a $20m study. Over-engineering can kill any project. If our public agencies are so committed to engineering it to death it would be nice to see some privateers get a more feasible proposal together and fund the much needed HSR with a mix of private and public funds. I think it would revolutionise living in regional SE Australia.

Going through the study, it reads like it was written for bureaucrats by bureaucrats. Money sliding off the table to fund other junkets along the way. For the extra costs included, a solar system with battery backup could power the whole rail without grid connection, could be built. Paid off in in just over 5 years with current wholesale power prices. A complete viaduct system could be built on costs suggested by the yanks.